As an internet & online marketing professional I often come across many retailers and when I ask them why they don’t have a cohesive strategy for e commerce some of their usual refrains are:

- Internet in India is small

- Indians do not like to shop online

- Channel conflict – This issue is generally raised by the Electronics/ Consumer Durable Brands that have very well established Dealer networks. They think that if they give lower prices online then they will have channel conflicts with their offline retailers which give almost 100% volumes and since internet doesn’t give them any sales, why on earth should they risk all for nothing?

- ROI- Why should I invest in setting up e commerce portal when it will not give me any sales?

I have recently seen lot of Leading Brands across many categories in India like Consumer Electronics, Real Estate, Automobiles etc. who are advertising heavily online for lead generation, which is passed on to the sales channels for conversions. Hence they are already using online media for Direct Marketing!

I do agree that not many people are buying these brands online and I have tried to map out the reasons for this and what do the retailers need to do to overcome these. I strongly believe that none of the above refrains used by Brands should be real deterrents for setting up their online stores.

Internet in India is small - Various estimates in India peg Internet users between 35 million to 80 million users with 6.8 Million Broadband connections.

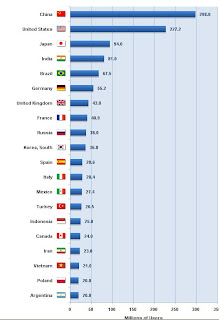

India is ranked 4th largest country in terms of Internet users by www.InternetWorldStats.com *

• Source: http://www.internetworldstats.com/top20.htm

Taking median of various estimates even at 45 Million users, we are way ahead of all European countries in terms of number of Internet Users. Another interesting comparison is with total

English print media readership in India is 50 million, Internet doesn’t seem small? Why should we then insist that Internet is small? It may be small in terms of revenues as of today, however by no means is it small in terms of reach or eyeballs.

What is also encouraging is that Internet connectivity is growing. We have an estimated 7 million Broadband users with an annual growth rate in excess of 60%. Some states are seeing Internet penetration at close to 10% levels! Also, with the advent of technologies like WiMax and Mobile Broadband we are all set to be poised to take a leap and eliminate all such connectivity issues in times to come.

Indians are averse to transacting online – As per industry estimates out of almost 1 million tickets sold by Indian Railways, 1 in 3 tickets are sold online by IRCTC. This translates into close to 300,000 tickets being sold online every day.

Also consider this, Almost 100,000 people fly every day in India on domestic air travel. It is estimated that almost 35% of these people book their tickets on various online travel portals. Another 20-25% book on the Airlines Websites directly through Internet. Hence almost 60,000 people are flying every day using tickets bought through the Internet!

The above would clearly indicate that if there is a compelling proposition (Convenience in case of Indian Railways & price comparison & transparency in case of Airlines) people will buy online. However, when it comes to non-travel online retailing, the numbers look woefully small. A research report by IMRB-IAMAI indicates that non travel online retailing was estimated to be only 850 crores in 2006-07. In 2009 it would have reached around 1200 crores.

Before we get into analyzing why Indians are not buying online, let us look at how consumer ecommerce is behaving in a developed market like USA. Forrester Research in its five-year e-commerce forecast for USA has reported that Online sales amounted to a whopping US$ 156 Billion in 2009 and it contributed to estimated 6 % of total retail sales in 2009. They further expect online sales to contribute to almost 8% by 2013.

The top ecommerce product categories in USA* are:

- Clothing & clothing accessories

- Drugs, Health & Beauty Aids

- Computer Hardware

- Books & magazines

- Electronic Appliances

- Furniture & home furnishings

- Toys & Hobbies. Etc

Let us look at the traffic on the websites of leading Brick & Mortar retailers in USA. The following numbers are taken from Comscore and represent the rankings amongst all websites in terms of visitors:

- eBay: 7th

- Amazon: 9th

- Wal-Mart: 22nd

- Target: 26th

From the above we can see that the top offline retailers like Wal-Mart & Target have a very significant traffic on their websites and are the 22nd & 26th most visited website in USA. Contrast this with the traffic rank as per www.Alexa.com of the big Indian retailers like:

- BigBazaar (www.FutureBazaar.com) : India rank 836

- ShoppersStop (www.Shopperstop.com) : India Rank: 1,847

Big Bazaar is at the top with an abysmal ranking of 836 this means that no Indian Retail brand is within first 800 most visited websites in India. We also need to see what are people really buying? Some of the products/ categories bought that are online are:

- Books

- Flowers

- Cheap / low priced electronic gadget

*Source: http://www.census.gov/econ/estats/2007/2007tables.html

Indians are not buying brands online. The big question then is what is holding people back from doing this? The IAMAI-IMRB research report has tried to answer this by citing time saving, convenience, variety & comparison possibility & discounts as reasons why people buy online. The same report lists Suspect product quality, Credit card security, lack of touch & feel, fixed price format & waiting for delivery as the chief reasons why Shoppers are shying away from buying online

However, I personally do not agree that people are not buying due to Product Quality, or not being able to negotiate or issues with security of credit cards. In terms of the reasons why ecommerce has not taken off in India I feel that following are the main reasons why ecommerce has not really taken off in India:

1. Cultural / Habitual – Indians look at shopping as an entertainment activity/ an evening out with family, when they go out to the Mall/ Market and shop, dine & enjoy. Ecommerce robs this completely! I am not sure that anyone can really address this issue! What the Brands need to realize is that how can they make themselves attractive online so that despite the Indian habits, people still get tempted to buy online.

2. Leading Brands not present online or present in a very non friendly manner:

We did a study of 14 Indian brands across genres to see their Internet & ecommerce presence. The results can be seen in the following chart:

Notes:

• Website URL- If not present on first page of Google search using different Brand terms, taken as website not available

• To determine if Brand is available on some other shopping portal, used google search with queries Buy + and listed just top 1-2

stores if brand available on some other shopping portal.

• Not considered listings in Auction Sites like Ebay or comparison sites like Naaptol.com, TolMol.com

A broad Analysis of the 14 Brands studied above show that more than half of the brands do not even have their own ecommerce enabled website! The ones that have ecommerce capabilities, only one brand gives some discounts on their website while almost all of them sell at MRP and they none of them have any offline-online integration. It is interesting to note that 6 out of 8 Brands that do not have their own ecommerce enabled site sell their products on some other shopping portal.

3. No offline / online integration

If one studies Wal-Mart’s bricks 'n clicks integration strategy i.e. tying its Web site into its real world stores, some very interesting things emerge, for example, few things that a customer can do are:

• Choose replacement tires at Walmart.com and have them installed at a local Wal-Mart.

• The site's pharmacy section lets you place an order to be picked up locally; you can also view your prescription history online and set up e-mail reminders for refills.

• Walmart.com’s vision center offers a similar service for contact lenses.

• You can drop off photos to be developed at Wal-Mart and see the finished prints at Walmart.com, where you can e-mail them to friends or make them into gift cards.

• If you buy an item at Walmart.com, you can return it at a local Wal-Mart.

• If there's an item your local Wal-Mart is out of, it's likely that the site has it. Walmart.com stocks 500,000 books and 80,000 CDs, not to mention replacement lawn mower blades, hot tubs, women's shoes, and Harry Potter Lego sets. Though the site doesn't release inventory figures, it's probable that it has the largest inventory of any retailer, online or off.

None of the 50% Indian Brands studied that have an ecommerce presence have done any offline-online integration. It almost seems that the online & offline stores operate in different silos. There is a huge need for integrating online & offline offerings by Brands. For instance why can’t a shopper just create her shopping list online and take delivery offline from her nearest Food Bazaar outlet and eliminate massive queues at checkout counters? Or why cannot these items be home delivered once a shopper puts them in her shopping cart online?

4. No real incentive to buy online – There aren’t any significant discounts.

Only 1 out of 8 brands I.e. FutureBazaar had some web only SKUs or discounts across products. None of the other 7 ecommerce enabled brands studies have web only offers or deep discounts. It almost seems that the Brands are really not interested in offering anything extra to people for coming online & shopping. Brands need to understand and make extra efforts into wooing users to buy online. Merely putting their catalogue online even with ecommerce capability doesn’t help the cause.

Channel Conflict: I recently came across a very large White Goods brand that has priced their products higher than the offline prices available in the market, as they said that they do not want to upset their retailers! Why on earth anyone would want to buy from them online in such a case? Online consumers are looking for DEALS DEALS & MORE DEALS. There are some easy ways of sidestepping the issue of channel conflict in case a Brand is offering lower price on their online store. Brand can create a product range that is Web Exclusive or push end of life products that can be deep discounted. Why can’t a Shoppers Stop continue its end of Season Sale 7 days more than at the offline stores, or better even begin it online 3 days prior to starting them offline?

Gen Next & online buying

The younger generation in India is growing with the presence of Internet all around them in homes as well as schools. With online connectivity increasing, more and more people will be spending increasing amounts of time online, consuming different kinds of media & engaging with online media in different manners. We have already seen Social networking impacting the lives of all of us already.

Studies indicate that even though users in India may not be buying online right now, but they are surely increasingly using Internet for their pre-buying research. This is becoming more evident in high involvement categories like Automobiles, Real Estate etc.

Also, with the urban families becoming more nuclear where all members are working, there is a huge paucity of time for people to go out for research before shopping. Hence it is apparent that it is only a matter of time that more and more shoppers will turn to research & then buying online. The question is Will the brands be available when they are ready to buy online?

Evangelizing V/s ROI

Most trends indicate that it is only a matter of time when the users will start shifting some percentage of their spending online and that online shopping can only increase from here. Why is it that the Retailers and brands are still not investing in having their ecommerce stores & presence?

One of the chief reasons can be their own myopic view. I have often hear retailers say that since online retail doesn’t give them sales in the short run, why should they invest in setting up & running an ecommerce portal ?

To some extent they are not unjustified in saying this. We also need to understand that organized retiling is a relatively new phenomenon in India and yet there is a huge opportunity and gap in terms of sheer physical presence of Brands in various geographies / catchment areas of their potential clients. Hence it is understandable that bulk of energies of the retailers will go in addressing this immediate opportunity at hand.

However, the Brands need to understand that the consumer’s habits can change much faster that what we sometimes expect and that it is only imperative that they are present where the consumers want to look for them and in the manner in which the consumers want to engage with them. In my mind there cannot be any debate on the importance for Brands to be available online.

What does it take to get online

The first step towards this is having your website ready with ecommerce & payment gateway integration. The Website should be ready with SKUs / catalogues integrated for ecommerce. Care should be taken for the following:

- Use technology that is robust and can handle volumes once business starts scaling up. Use of Open source based OScommerce(www.oscommerce.com) , xcart (www.x-cart.com) , zencart (www.zen-cart.com) , etc or commercial technologies like Octashop (www.octashop.com) , Martjack (www.martjack.com) are recommended

- Technology should allow quick addition & modification of SKUs using good Content Management System. One can use Open Source CMS like Joomla (www.joomla.org) Drupal (www.drupal.org) , typo3(www.typo3.com) , or commercial custom build solution offered by many technology companies like Mind tree, ANMsoft etc.

- Quick creation of Catalogues for offers & promotions.

- Provide world class User Interface (UI) & navigation. Some of the companies who can help in creating state of art UI design are HFI, Wirefoot etc.

- Website should be designed with Search Engines friendliness in mind.

- Payment gateway with multiple payment options like Credit cards, debit cards, cash on delivery. Most commonly used gateway are cc avenue, DirecPay, EBS (axis bank), ICICI Payment Gateway, HDFC Credit Card Gateway, also some mobile payment gateway are atom, Mcheck etc.

- Defining standard work & process flows for handling & fulfilling online orders.

- Tying up with Logistics partners like Aramex, First Flight, Elbee etc. I would recommend offering options like Cash on Delivery to customers as well.

- Defining pricing & promotion policies with adequate incentives for shoppers to buy online

- Laying our proper offline & online integration

- Ensuring proper customer support using call centres. Also ensuring having SOPs with all escalations laid out for handling customer queries & issues in a very prompt manner.

- Driving customers online –Brands can drive customers online through a variety of activities. I am listing a few of them:

- Design a calendar of ongoing web only promotions

- Communicate these promptly to their own user databases & through online marketing.

- Can use different channels of online marketing like - Search, Affiliate, Display advertising

- Look at a life time value of a potential customer. Drive users to register on their website for

receiving information and updates about various offers & promotions

- For higher value products & higher involvement products actively collect intent / leads from

potential consumers and use tele-marketing or offline channel to close the sales.

- Run innovating customer reach programmes online like Click to call.

- Integrate Mobile with web.

I am sure, if Brands & retailers make a sustained strategy to harness the power of ecommerce it can become a significant channel for sales & Brand engagement for them with their customers. This of course needs a long term vision & commitment.

__________________________________________________________________________

First published in Images Business of Fashion November ’09 issue